Unlock Exclusive Access to Proven Real Estate Success Strategies

Looking for an BETTER way to grow your real estate portfolio?

Get Insider Access To The

Ground-Breaking Strategy That

Helped Us Achieve Financial Freedom and Multi-million Dollar Net Worth in Just a Few Short Years

Time is Running Out and Seats Are Limited.

Don't Miss Out On The Upcoming 4 Week Live Webinar!

You Still Have Time To Register

Class begins SEPTEMBER 3RD, 2025

Does Any of This

Sound Familiar?

Frustrated by how hard it is to find real estate deals?

Maybe you're a wholesaler, discouraged by the endless competition

Tired of your Cash Offers constantly getting rejected?

Sick of getting laughed out of seller appointments due to your lowball wholesale offers?

You're a Buy & Hold investor but struggling to find deals at these sky high prices

Wondering how other investors overpay and find a way to make a profit?

Record high mortgage interest rates got you down?

Don't have the cash to put 25% down on every property?

What if there was a way to invest in real estate without being at the mercy of traditional financing methods?

AND NO, IT

DOESN'T MEAN

YOU HAVE TO:

Have a huge amount of cash on hand

Rely on bank loans and other financial institutions

Or even sacrifice your sanity navigating the red tape

SOUND too good to be true?

Enter

Seller Financing

An innovative and proven real estate strategy that's been under your nose all along.

Consider this: you've found the “perfect” property in an up-and-coming neighborhood. The property is a rental that the seller has owned for many years. The tenant is paying $1,200 per month, market rent for the property is $1900/month. The seller is asking $320,000 for the house.

Once totally renovated the house will sell for $325,000. But due to the property needing about $75,000 in repairs to flip, it's not worth $320,000 AS-IS. This is the dilemma wholesalers and investors face every single day.

You run your numbers and present the seller a Cash Offer of $175,000 with a 30 day close. The seller gets upset and says "Liston, I'm not going to give my property away, I've had other buyers offer me $280,000, you know what, don't ever contact me again!"

Well that escalated quickly! But guess what, this happens every single day.

The solution is offering the seller Owner Financing terms. With Owner or Seller Financing you make payments over time, which allows you to pay more because you're spreading out the payments. In this scenario in addition to the cash offer we'd present the seller with the following offer:

Purchase Price: $320,000

Down payment: $5,000

Loan amount: $315,000

Monthly mortgage payment: $900

Term: 10 years

Balloon payment due at end of 20 years: $215,000

How do you make Money on this deal?

Wholesale or Assign your contract for a $10K wholesale fee

Buy & Hold

Down payment + closing costs: $8,000

New Rent Amount: $1,800

Monthly expenses: $1,300

Monthly Cash Flow: $500

Time it takes to get your $8K back: 16 months

We do these types of deals all the time. In fact 98% of our rental portfolio was acquired via Seller Financing. This is also how we not only survive but Thrive in a Seller's Market where prices are extremely high.

So, instead of going through the tedious process of applying for a bank loan, you approach the seller directly. You both agree on a purchase price, just like a regular deal.

There's no need for a load of paperwork or waiting for approval from a traditional financial institution. It's a private agreement between you and the seller, documented with a Deed of Trust also known as a mortgage, and a promissory note. The Deed of Trust offers security to the seller who can foreclose and take the propety back if you stop making payments. And the promissory note outlines the terms of the loan, such as the interest rate, repayment schedule, and what happens if you don’t pay.

What Does This Mean

For You, The Investor?

First, you no longer have to worry about being outbid by other investors. You can pay the seller's ASKING PRICE sometimes even OVER ASKING and still make money. You negotiate directly with the seller, creating a deal that benefits both parties.

Second, your lack of cash is no longer a barrier. In this business it's easy to run out of cash. But with Seller Financing, you don't need to come up with 25% down payments every time or deal with sky-high interest rates. On average, we pay about 3-5% down, sometimes even less. And often are able to negotiate montly mortgage payments with 0% interest.

Third, No credit needed. Doesn't matter if you have good credit or bad credit. Your credit score doesn't matter like with a traditional home loan.

And fourth, you and the seller eliminate paying a real estate agent's commission, which often amounts to around 6% discount to you.

In a world where we're accustomed to believing that big banks and mortgage companies are the only sources of financing a house, Seller Financing changes the game.

But as promising as it sounds, like any investment strategy, Seller Financing also requires the proper know-how to execute effectively.

And that's where we can come in…

Introducing:

Financing Freedom

What Is Seller Finance?

The term “seller financing” refers to the property owner extends a loan to the buyer to fund the property purchase. A seller financing agreement is beneficial for both buyer and seller as it eliminates the need for intermediaries, such as banks, mortgage companies, realtors, etc.

Designed specifically for real estate investors eager to adopt a new way of growing their portfolios, increasing cash flow, and building generational wealth, Financing Freedom is a 4-week course that walks you through the ins and outs of Seller Financing.

Seller Financing can be a goldmine for your sellers who want to transform their property into a high-performing asset and enjoy a steady stream of ongoing income in this ever-fluctuating market. Let us show you how!

How Financing Freedom Helps You Unlock Your Wealth Building Potential

Learn From

the Best

Dedric and Krystal Polite, the power couple behind a $7 million portfolio built virtually entirely through Seller Financing, are here to share their expertise. They've successfully negotiated various types of properties across the US, from houses, to apartment buildings to commercial properties, to mobile home parks.

Structure Deals

Like A Pro

Structuring win-win deals with sellers is at the heart of Seller Financing. In Financing Freedom, you won't just learn how to structure deals; you'll learn how to problem solve and create win-win solutions. After completing the program, you'll be well-positioned to approach any seller with a proposition that's too good to pass up, eliminating the need for lowball offers.

Master

Every Aspect

Financing Freedom isn't just an introduction to Seller Financing. It's a deep dive into the nitty-gritty of how to implement this life changing creative strategy into your business. We cover everything from identifying eager sellers to how to put together win-win deals.

And we're not kidding... this isn't a get-rich-quick gimmick. It's a strategy that has proven its worth time and again.

Here's Everything You'll Discover Inside Financing Freedom

The ABCs of Seller Financing, so you can confidently use this strategy to increase your cash flow and grow your net worth.

How to Find Sellers who are looking for investors like yourself to Owner Finance their properties to. Sometimes we even get entire portfolios!

Learn how to communicate with sellers, using persuasive language patterns and offers that establish rapport, build trust, and get you to the closing table.

Develop the ability to quickly assess a seller's situation and tailor your approach accordingly.

Gain a deep understanding of transaction engineering, ensuring every deal you make is financially sound and sustainable.

Learn how to calculate exactly how to make a deal profitable, avoiding pitfalls and aligning your investments with your short and long-term goals.

Master the art of creating compelling offers that sellers can't resist. So sellers come back to you time and time again when they want to sell their properties.

Explore negotiation techniques that not only give you the favorable terms but also benefit the other seller – making you the preferred choice in the market.

Understand vital concepts like contracts, closings, and due diligence to yield smoother transactions and secure your investments.

Get hands-on with practical techniques for managing both your properties and loans. This allows you to seamlessly balance your financial obligations with property management and maintenance.

Learn how to attractively market your properties to potential buyers and renters, ensuring quick sales and consistent cash flow.

Dive deep into the process of structuring loans to optimize your investment strategy.

Get clear on how insurance will be handled in your deals, protecting your assets and peace of mind.

Familiarize yourself with the specifics of wholesaling a Seller Finance Deal. This lesser-known yet immensely profitable method of wholesaling will add another dimension to your real estate toolbox.

By The End Of This 4 Week Accelerator, You'll Have A Toolbox Full Of Tried And True Strategies That Will Give You A Massive Edge Over Other Investors In The Market.

Real Success Stories from

Real Investors Like You

Still not convinced? The Proof is in the Pudding: Here's some

real life testaments to the power of seller finance:

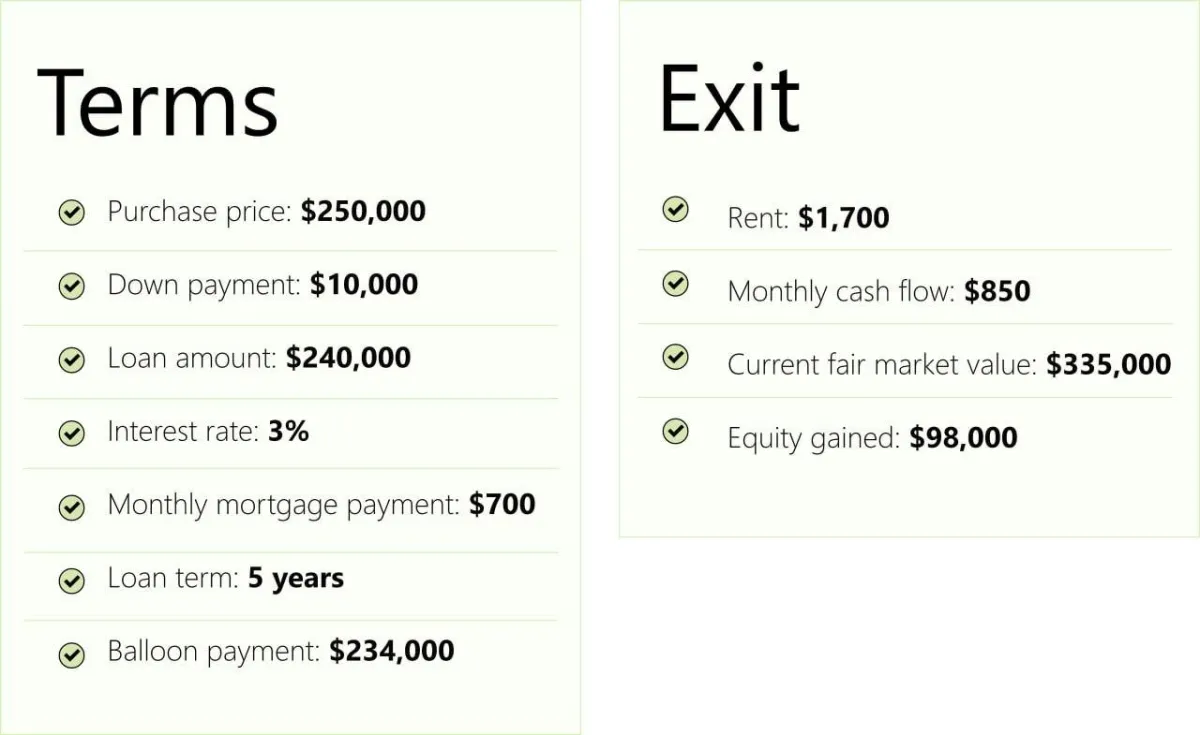

Charlotte Property

Found this property cold calling list of absentee owners, aged over 65 who own their properties free and clear. This 70 something couple was looking to sell due to the tenant stressing them out and not paying rent on time. Even though the rent was well below market. But they were adamant about now giving the property away. Fair market value $200K. Asking price $250K. Cash offer was $135K, so they were asking double what we were able to pay on a cash offer basis. Enter Seller Financing!

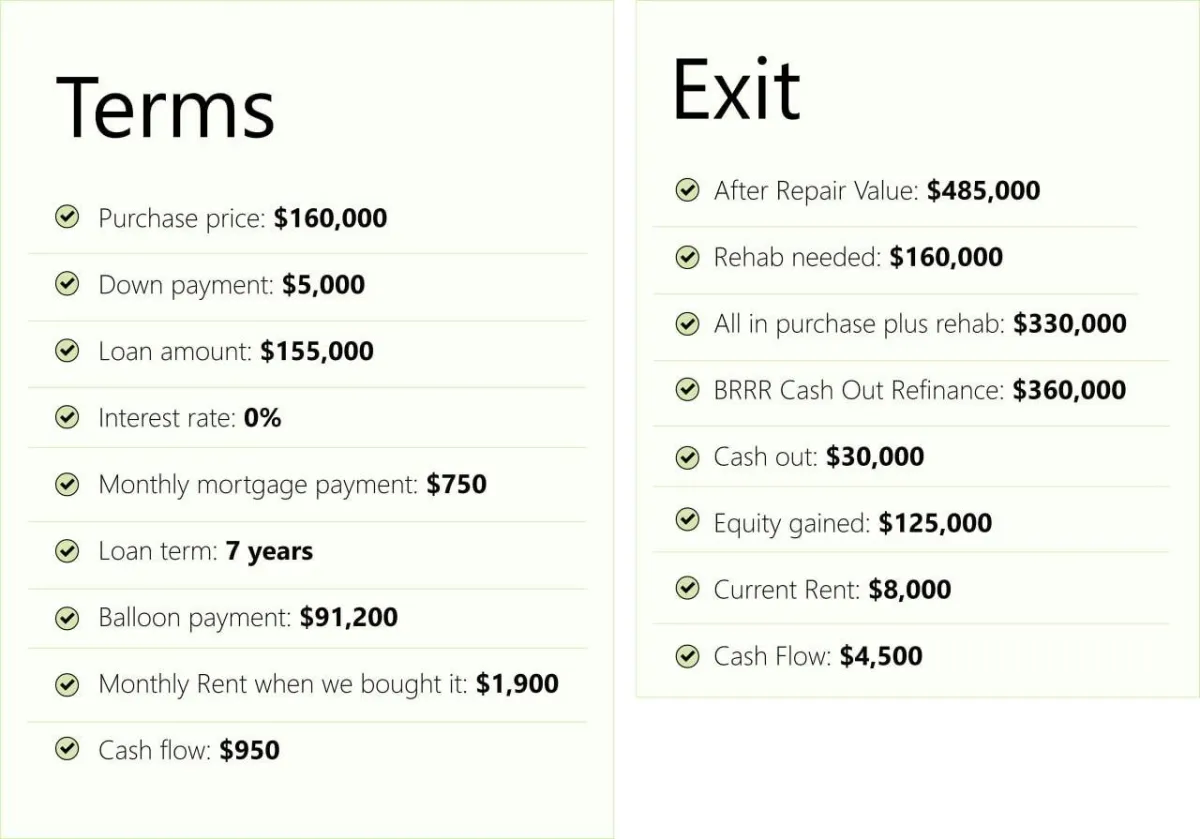

Apartment Building 1

We found the seller driving for dollars. Seller was in his mid 80’s and owned a large portfolio. His properties had a lot of deferred maintenance and tenants had stopped paying rent on time so he was experiencing a loss of income. We were his lifeline. BUT, He still wanted retail price for his properties. He Would not accept cheap cash offers, so we offered him his price if he gave us favorable TERMS. He agreed.

Apartment Building 2

We bought this 4 unit apartment buildind from the same seller. This one was in an even better location just steps to the historic downtown, so he wanted more money for the property. After flat out rejecting our initial lowball cash offer. We went back and forth over a matter of months and finally came to terms that worked for both of us.

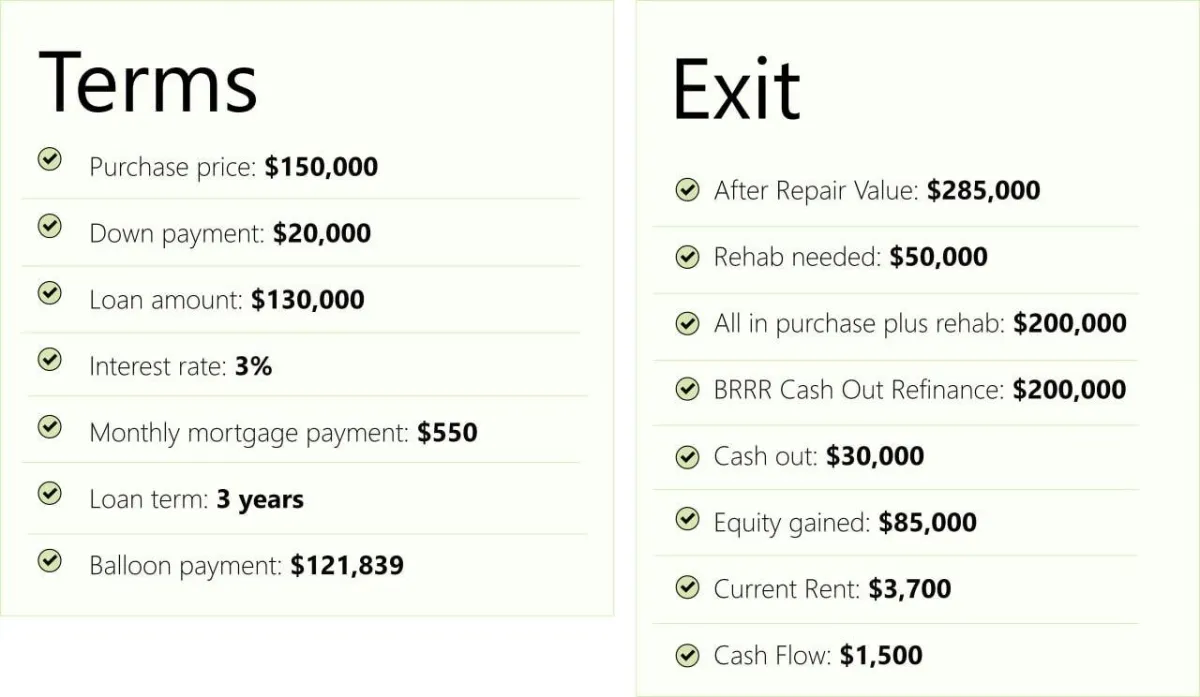

Getting Paid to buy a Duplex :)

The sellers were a 70 something couple that owned this property for 35 years. The tenant's weren't paying, and they were tired of the stress. Their asking price was $150,000. Based on the max offer formula, our cash offer was $115,000. Of course they said no. We then proposed seller financing, and after a little back and forth they said yes.

Financing Freedom Is

For You If You Want To

Grow Your Cash Flow and Net Worth FAST

No longer will you be at the mercy of traditional financing norms. Where you can only buy 1 rental property every few years because of the hefty 25% down payment requirement. With seller financing you can buy with low to no down payment and cash flow from Day 1 with the right terms!

Stand Out From The Crowd

There's millions of wanna be investors and wholesalers out there. And they're all following the same tired cash offer formula. With Seller Financing, you gain entry into a niche market segment with fewer competitors and more profitable deals.

Close Faster with Less Red Tape

We've contracted and closed Seller Finance deals in 14 days. Vs 30-60 days or more when you're getting a traditional mortgage loan. They say time is money, Say goodbye to the never-ending red tape of bank loans. Seller Financing offers a smoother, faster, and more reliable path to closing deals so you can focus on what matters most – growing your investment portfolio.

Here's what

you'll learn...

Week 1

Intro to Seller Financing

What Seller is Financing

The Problem with cash offers

What makes Seller Financing the best acquisition strategy

Why you should build your rental portfolio on seller finance

How Seller Financing is different from other forms of "Creative Financing"

Common misconceptions of Seller Financing

Week 2

Marketing

How the mechanics of Seller Financing work

What terms are negotiable in Seller Financing

What terms are typical in Seller Financing

Common misconceptions and oversimplifications people often make about Seller Financing--and what the truth is

How to Find Seller Finance Leads

Our Secret List

How to Find Sellers Contact info

What contracts are needed in Seller Financing

Week 3

Acquisitions

The benefits to Seller

The benefits to Buyer

You got a lead, what next?

How to Build Rapport with Sellers

Common Seller objections and overcoming them

How to make an offer and why we always make 2 offers

Formulating 2 Offers

Determining Cash Offer

Determining Your Seller Finance Offer

Week 4

Dispositions: Seller Finance

- Exit Strategies

Seller Finance Exit Strategies

Rules for Structuring Profitable Deals (Underwriting)

Sub2

Negotiations 101

Getting Contract signed

Ready To Tap Into

The Power of

Seller Financing?

If you're tired of the constraints of traditional financing, if you're craving more control over your investments, and if you're ready to boost your return on investment, it's time for a change.

Learning how to buy with Seller Financing is not just an option. It’s a NECESSITY in today's market.

In Financing Freedom, we'll guide you step-by-step and teach you the ropes of seller financing, connect you with the right resources so you can negotiate the most favorable terms, and set up amazing deals that maximize your profits.

Enroll now and develop the niche-specific skill set, confidence, and expertise critical to succeed in this new era of real estate investing.

Frequently Asked

Questions

Will This Work In My Market?

We’ve taught seller financing to individuals from Oregon to Boston MA, to Texas, to South Carolina, and everywhere in between. Real estate investing can be done virtually from anywhere. The only way to predict the future is to create it! Prove to yourself that this works, just like we did.

Do I Need a Real Estate License or Experience?

No you do not need a real estate license. Neither one of us have a license. Most people don't realize that as a private individual you can purchase or sell a property without using a Realtor. Now we do use and recommend using title companies and closing attorneys to close the deals and handle the paperwork.

How Much Time Do I Need?

The Accelerator is 4 weeks, but that’s just the start of your journey to financial freedom through creative real estate investing. You will have lifetime access to the recordings and course materials . You can listen to the recordings while driving, on the bus or even at work with headphones in.

Do You Offer Refunds?

If you request a refund before the start of Week 1, then we will gladly refund you. However once the weekly training sessions begin we will not be issuing refunds.

Is this training live?

Yes, this is a live training course which is typically 1.5 hours each session depending on questions. It's the first 4 weeks of the month.

What's the schedule for the training?

We will meet Wednesdays at 7pm Eastern LIVE for the 4 Wednesdays of the month. Typically each training lasts about 1.5 hours a day depending on the number of questions.

Do I get access to recordings?

The recordings will be posted online within 48 hours of the live training.

Can I do this with a friend or partner?

Yes. You can invite your business partner, I would not recommend bringing a random friend that has nothing to do with your business.

Do you have a referral program?

Yes we do! Refer a friend and you get 20% of what they pay for the accelerator. Email us for an affiliate link!

If I have questions, can I contact you?

If you have questions or are looking for further mentorship, we have additional programs, ask us about them! Email us at [email protected]

Who is this training for?

Anyone who’s looking to make extra money. Wholesalers, flippers, landlords who are struggling to find and close deals.

For those who always wanted to get into real estate investing but don’t know how. For those who love what they do but just want to find a way to make an extra $10K per month. For those who want to escape the rat race. Whether you’ve done 0 deals or 5, there’s something here for you.

If wanted, are there additional training or coaching opportunities?

Yes we can take someone as far they want to go. We have built a large rental portfolio, do fix and flips on national TV, wholesale houses, have multiple Airbnbs and specialize in creative investing, we help people from all over the US duplicate our business model in their area.

We encourage everyone who wants to improve and scale to look into joining our Community. Click this link to schedule a strategy session and see if you’re a good fit. Click this link to schedule a strategy session with our team.

A Note From The Polites

“The best way to predict the future is to create it.” - Peter Drucker

This saying has never been truer than today. Ok, let's talk real life for a sec. Every few years, it feels like society is scrambling to figure out what's next. Some folks are legit sweating over how to keep the lights from getting shut off tomorrow. How to pay the mortgage or rent. Credit card bills...late, car payments...late, we've all seen what it looks like when bills pile up and payments decline. What about the ones of us who have nothing on autopay because we can’t be 100% sure there will even be money in the account when the time comes for payment. We know that feeling because that was us growing up.

Krystal once said "they require us to work 40-60 hours a week, for 2 weeks vacation a year, for 40 years. Then we are expected to enjoy the last 15-20 years of our life (God willing) when we are too tired and our bodies are too worn down to enjoy it." We have to rethink this.

Here's the deal: we're living in times with social and political uncertainty, inflation, and coming out of a global pandemic. Prices are playing limbo, and saving money is like trying to catch a unicorn – not happening. Financial planning got a facelift, my friend. Now, it's not just about saving; it's about making more money to ride out this constant financial rollercoaster.

Look, we’re not about wasting your time or ours. We are here to spill the beans on how we didn't just survive but straight-up thrived during the economic meltdown in 2020. So, buckle up, because we’re here to share the real talk on how to not just weather the storm but dance in the damn rain! Alright, listen up, on how you can flip the script on your lifestyle and set your family up for generations. This ain't just about surviving the economic rollercoaster; it's about thriving, no matter which way the wind blows.

Now, let's talk real talk about real estate. It's the OG, the timeless investment that doesn't play games with short-term trends like crypto and NFTs. This is no get-rich-quick scheme; it's the real deal, standing strong against the test of time. That's why this course is like gold for your entire life.

Imagine this: you'll never be short of folks hunting for a sweet deal, and you sure as heck won't run out of opportunities for yourself. Structuring sweet deals – now that's a skill people drop serious cash to learn. Get ready to take the wheel, my friend. This accelerator isn't just an investment; it's your ticket to finally driving your own life.